Price to book ratio formula

It means the company may reduce the selling price of its products by 2582 without incurring any loss. The formula for the consumer price index can be calculated by using the following steps.

P B Ratio Financial Statement Analysis Fundamental Analysis Financial Ratio

A PEG ratio of 10 or lower on average indicates that a stock is undervalued.

. A PEG ratio greater than 10 indicates that a stock is overvalued. Citigroup Price to Book Value Ratio 2014 73277157 1023x. From there market capitalization and net book value can be calculated.

The Market to Book ratio or Price to Book ratio can easily be calculated in Excel if the following criteria are known. Read more or PriceEarnings to Growth ratio refers to the stock valuation method based on the. A general measure of the companys ability to pay its debts uses operating cash flows and can be calculated as follows.

Firstly select the commonly used goods and services to be included in the market basket. The term PEG ratio PEG Ratio The PEG ratio compares the PE ratio of a company to its expected rate of growth. Citigroup Price to Book Value Ratio 2015 732768174 1074x.

The market basket is crated based on surveys and it should be reflective of the day-to-day consumption expenses of the majority of consumers. Solvency Ratio 32500 5000 54500 43000 Solvency Ratio 38 Explanation of Solvency Ratio Formula. There are a few different ways to calculate the cash flow coverage ratio formula depending on which cash flow amounts are to be included.

It is calculated by dividing the current closing price of. Example Calculation of Market to Book Ratio in Excel. The basic components of the formula of gross profit ratio GP ratio.

Price of Citigroup as of 6th Feb 2018 was 7327. More PE Ratio - Price-to-Earnings Ratio Formula Meaning and Examples. Cash Flow Coverage Ratio Operating Cash Flows Total Debt.

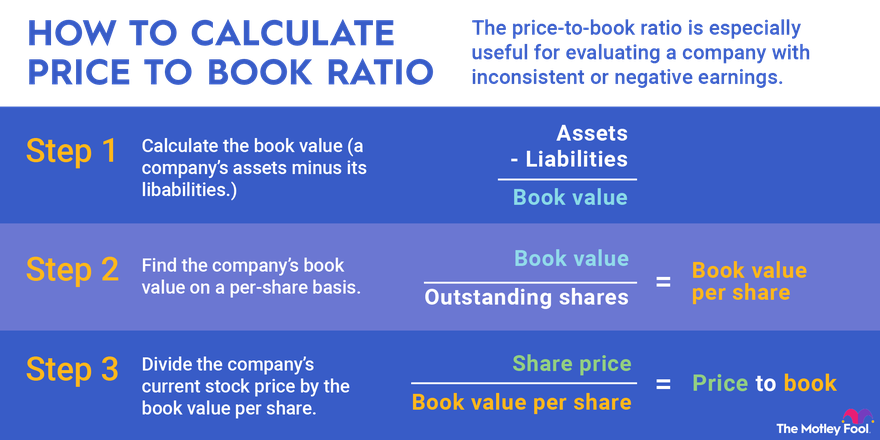

What is PEG Ratio Formula. Share price number of shares outstanding total assets and total liabilities. The price-to-book ratio PB Ratio is a ratio used to compare a stocks market value to its book value.

First of all when an investor decides to invest in a company she needs to know how much she needs to pay for a share of the net asset value per share. The GP ratio is 2582. The price-to-book PB ratio evaluates a firms market value relative to its book value.

Price-To-Book Ratio - PB Ratio. Solvency ratio is one of the quantitative measures used in finance for judging the company financial health over a long period of time. This is better than my text book.

Price To Book Value P B Definition Formula And Example In 2022 Book Value Price Fundamental Analysis

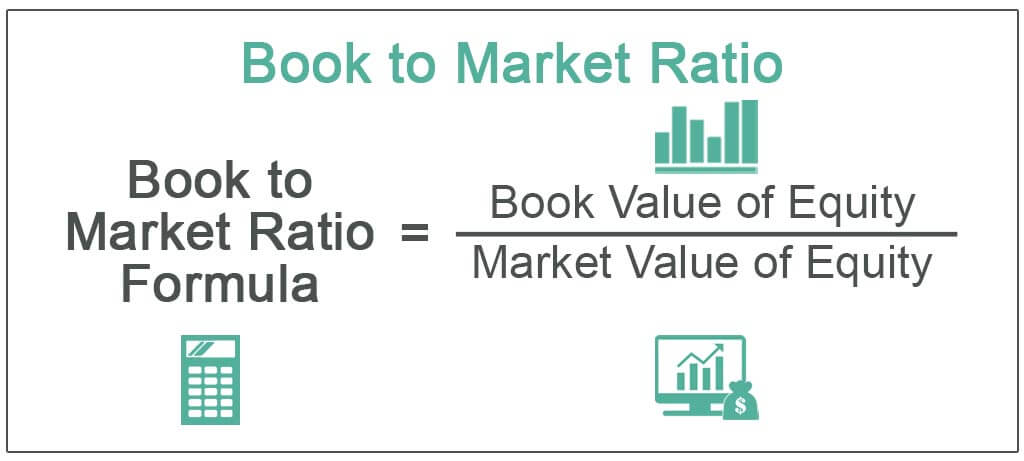

Book To Market Ratio Definition Formula How To Calculate

How To Calculate The Book Value Per Share Price To Book P B Ratio Using Market Capitalization Youtube

:max_bytes(150000):strip_icc()/dotdash_INV_final_Does_a_High_Price-to-Book_Ratio_Correlate_to_ROE_Jan_2021-01-e4cae6527f3a4ceb9a5725061235d83c.jpg)

Does A High Price To Book Ratio Correlate To Roe

/dotdash_INV_final_Does_a_High_Price-to-Book_Ratio_Correlate_to_ROE_Jan_2021-01-e4cae6527f3a4ceb9a5725061235d83c.jpg)

Does A High Price To Book Ratio Correlate To Roe

Are Stocks With A Low Pe Ratio Generally Safe To Buy In 2022 Business Quotes Investing For Retirement Value Investing

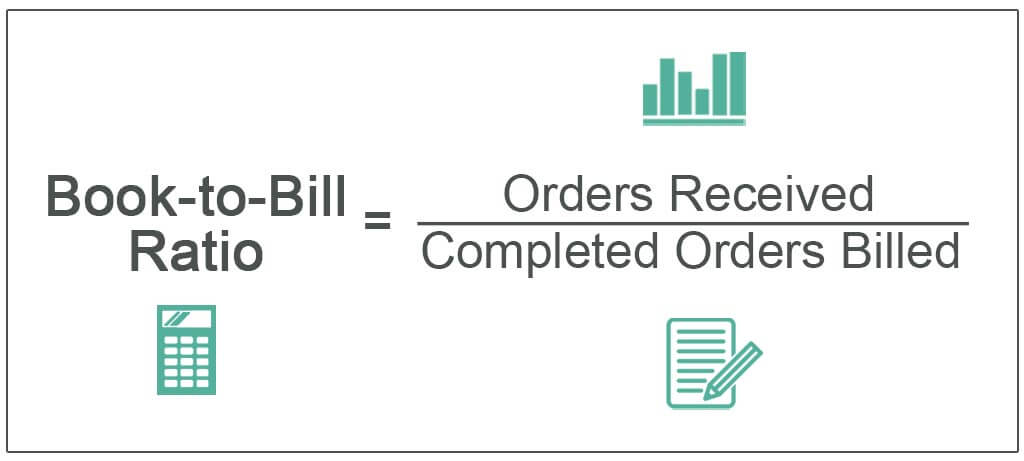

Book To Bill Ratio Definition Examples How To Calculate

What Is The Intrinsic Value Formula Try This Online Calculator Getmoneyrich Intrinsic Value Learning Mathematics Fundamental Analysis

Using Price To Book Ratio To Analyze Stocks

Price To Book Ratio Definition Formula Using To Use It

Price To Book Ratio P B Formula And Calculator Excel Template

Price To Book Ratio P B Formula And Calculator Excel Template

Pin On Malaiyurmedia

Financial Ratios Top 28 Financial Ratios Formulas Type Financial Ratio Debt To Equity Ratio Financial

Common Financial Accounting Ratios Formulas Financial Analysis Accounting Small Business Resources

Intrinsic Value Calculator And Guide Discoverci Intrinsic Value Value Investing Stock Analysis

Price To Book Ratio P B Formula And Calculator Excel Template